Oct 15, 2025

Dec 15, 2025

Feb 15, 2026

April 15, 2026

If you have your sights set on a senior-level position, a master's in accounting will help you stand out from the competition. For those seeking the CPA license, the program offers comprehensive preparation for the exam. The degree also signals to potential employers that you are well-versed in the latest technology and developments in this constantly evolving field. Most MS in accounting graduates see a boost in their professional roles and salary in an already lucrative field.

Students with an accounting background can choose from a range of courses in financial reporting and assurance, forensic accounting, or taxation. All students select elective courses to supplement their specialty.

Full-time students typically complete the program in 1 year. Part-time students typically complete the program in 2+ years.

Choose the path that fits your lifestyle. Our in-person program offers small cohorts and a chance to connect with peers and faculty, while the online program brings Washington, DC, to you, no matter where you are.

Why a Kogod MS in Accounting?

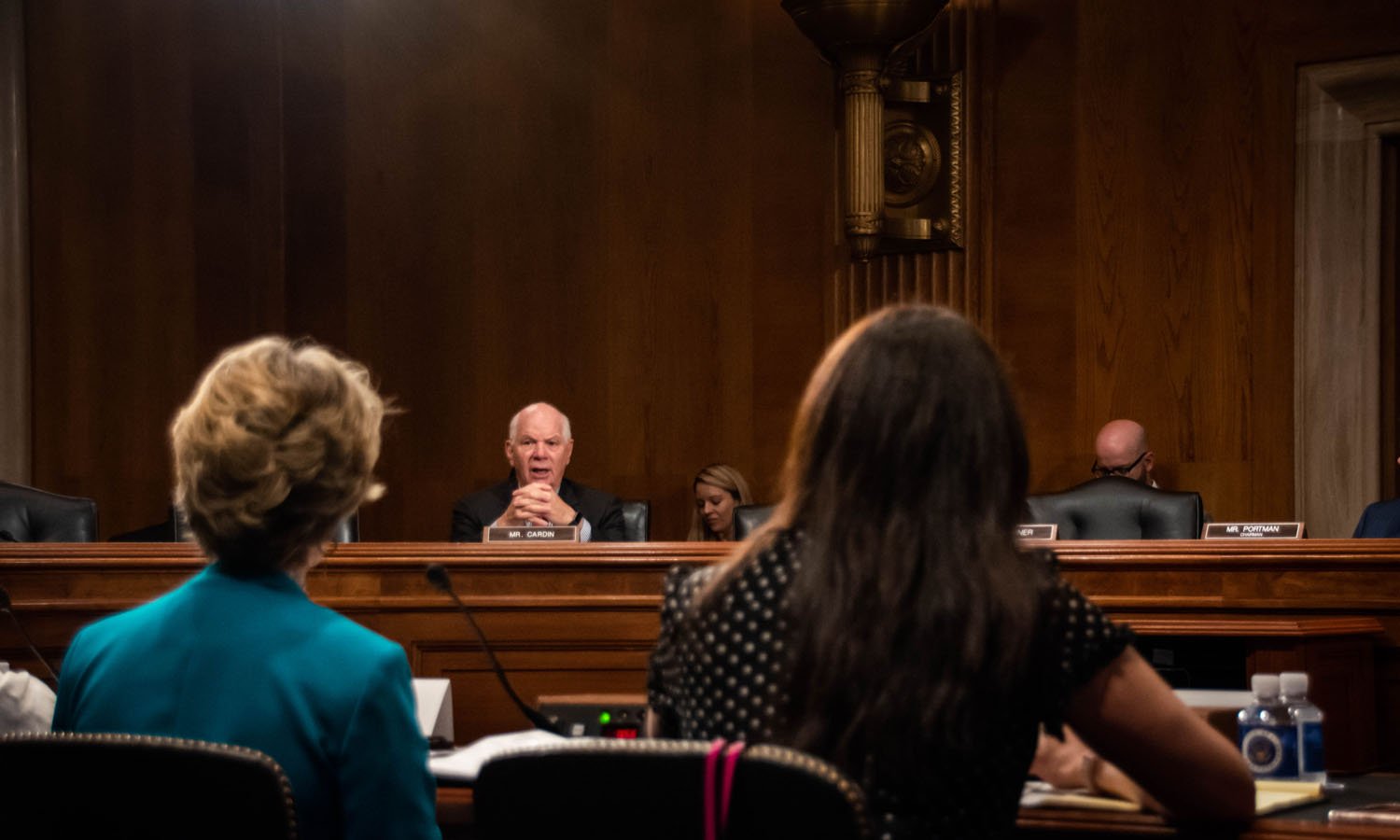

Ideal Location for Accounting Professionals

Our campus is located in Washington, DC, one of the most exciting job markets for accounting professionals. Companies like Deloitte, EY, KPMG, and PwC are right outside our door. In addition, governmental agencies, nonprofits, and other organizations are ready for your expertise.

Résumé-Building Credentials

Our graduate accounting and tax courses are designed to get you ready for CPA licensure. In addition, we are one of the few universities to have a partnership with the ACCA. Our affiliation exempts you from eight of their global certification exams, accelerating credentialing for our graduate students seeking global career pathways.

Practitioners as Faculty

Our faculty are not only excellent educators, but they continue to be actively engaged with their profession. They use hands-on methods to teach students accounting skills through experiential exercises and collaborative projects. Plus, accounting experts from the Big Four and boutique firms like Cohn Reznik and Baker Tilly are regular guest speakers.

Professional Certificates

Gain an edge in this competitive job market by completing one of our professional graduate certificates. Enhance your degree with a certificate in forensic accounting, taxation, analytics, or business fundamentals.

A graduate certificate is a great way to add valuable skills that will enhance your accounting career and keep you professionally competitive.

Analytics

With an understanding of analytics, you’ll be able to offer critical business insights, like how to better manage risk, predict consumer behavior, identify new opportunities, and more.

Forensic Accounting

In addition to gaining the skill to spot and stop fraud, a graduate certificate in forensic accounting gives you access to a fast-growing job market and a higher earning potential.

Taxation

Everyone needs a tax accountant, and with a certificate in taxation, you’ll be qualified to work for the largest professional service firms in the world or open your own business.

The MS in accounting program consists of 30-37.5 credit hours, depending on your academic background. Our flexible curriculum means you can tailor your plan of studies to suit your goals.

Comprehensive Core

You'll have the opportunity to take foundational courses, which will give you an overview of fundamental concepts in accounting, finance, economics, and statistics. This will be determined by the program director based on prior coursework.

You will also complete core accounting courses, covering everything from tax planning for individuals to business law and audit services and everything in between.

Flexible Experience

Under the guidance of the program director, you will prepare an individualized plan of study with your professional goals in mind. You can choose to focus on financial reporting and assurance, forensic accounting, or taxation. Alternatively, you can select from either graduate accounting or related business courses to develop expertise in a related field.

You'll Walk Away With

- Functional Competencies—competency in the functional areas of accounting in the global business environment (audit, financial, managerial, and tax).

- Analytical Problem Solving—competency in applying quantitative information, technologies, and professional judgment in solving business problems.

- Research—proficiency in the use of research databases to provide insights on current accounting and tax issues.

- Professionalism—ability to understand the role of the accounting profession and the important professional, legal, and ethical obligations of accounting professionals.

STEM-Designated Specialization

Our STEM-designated accounting program is available to graduate accounting students who are accepted into the accounting analytics specialization and complete four courses that are specific to the STEM designation. The designation may allow F-1 international students to apply for a 24-month extension of their Optional Practical Training, granting them the ability to work in the US for up to three years in their major field of study.

Partnership with ACCA and ACFE

We are one of the few universities in the US to have a partnership with ACCA. By completing the MSA program, you can waive up to 8 of their 14 exams. We will also help you prepare for the ACFE's exam and CFE credential, the main certification for international anti-fraud professionals.

Expert Faculty

Before joining the faculty, Casey Evans was senior director of forensic & litigation consulting at FTI Consulting, where she specialized in conducting complex forensic accounting and financial fraud investigations in conjunction with the SEC, DOJ, and corporate audit committee inquiries. She was part of the team of FTI investigators responsible for investigating Bernard Madoff and Bernard L. Madoff Investment Securities, one of the largest investor frauds in American history.

Kogod’s MS in accounting is also available entirely online. Ranked no. 16 by US News & World Report for Best Online Graduate Programs in 2021, our online degrees are packed with hands-on learning experiences that can easily transfer to a career in accounting.

*Black = Black or African American; Hispanic = Hispanic/American or Latino; AIAN = American Indian or Alaska Native; NHPI = Native Hawaiian and Other Pacific Islander.

Evans joins the Kogod community from Harare, Zimbabwe, and holds a bachelor’s in accounting from the University of Zimbabwe. He wants to become a certified public accountant (CPA) and later an accounting executive, and saw Kogod as a school that would help him reach his goals. Evans says, “with its esteemed faculty members and resources that would be available to me as well as its rigorous training and mentorship programs, I knew that I would be in the right hands. With Kogod the aim is to fly high like an eagle. After completing the program, I will be positioned to excel.” To hear from Evans about his experience as a Kogod student, schedule a one-on-one chat with him!

Tatenda comes from Zimbabwe, and earned his bachelor’s of accountancy at Bindura University of Science Education. He chose Kogod because of its strong reputation as a business school, its emphasis on experiential learning, and its robust alumni and mentorship network. After completing his degree, Tatenda wants to take the chartered accountant exams so that he can ultimately work in accounting consultancy and start his own accounting firm. Schedule a chat with Tatenda to hear more about his time as a Kogod student!

Our graduates have found professional success in a wide range of industries that span the public, private, and nonprofit sectors. Six months after graduation, 90 percent of our students report they are either fully employed, in graduate school, or both.

Graduates of the program can work as:

- Auditing manager

- Chief financial officer

- Corporate controller

- Internal auditor

- Tax accountant

- Treasurer

Recent employers include:

- Deloitte/Deloitte & Touche

- EY

- KPMG

- PwC

- CohnReznick

- Fannie Mae

- FTI Consulting

- International Monetary Fund

- Navigant Consulting

- SC&H Group

- Jane Goodall Institute

- Johnson & Johnson

- US Marine Corps

Gabrielle Vella, a BS in business administration and MS in accounting 2021 graduate, discusses her Kogod School of Business experience on Campus Reel.

“The reason I chose this program was because it’s a great set-up for someone that’s interested in taking the CPA; a lot of the classes are extremely helpful and overlap with a lot of the study guides that are offered.”

Upcoming Admissions Events

Interested in grad school but don't know where to start? We can help! Learn more about the different programs Kogod has to offer, and find the right fit for you. This is a live webinar, and you will be able to ask questions. Register Now

Applying to graduate school can be confusing. Let us help! Join our Kogod Graduate Admissions team for an informational overview covering application deadlines, requirements, and timelines. This will be a live session and attendees are welcome to ask questions during the program. Register Now

Interested in grad school but don't know where to start? We can help! Learn more about the different programs Kogod has to offer, and find the right fit for you. This is a live webinar, and you will be able to ask questions. Register Now

Applying to graduate school can be confusing. Let us help! Join our Kogod Graduate Admissions team for an informational overview covering application deadlines, requirements, and timelines. This will be a live session and attendees are welcome to ask questions during the program. Register Now

Interested in grad school but don't know where to start? We can help! Learn more about the different programs Kogod has to offer, and find the right fit for you. This is a live webinar, and you will be able to ask questions. Register Now