MS in Finance

Oct 15, 2025

Dec 15, 2025

March 1, 2026

April 15, 2026

An MS in finance gives you the technical skills for that next step in your career. The program prepares you for the CFA, CAIA, CFP, and FRM exams, which will open up leadership positions and other professional opportunities. Plus, this targeted expertise will help you better position yourself in today's job market.

Take the next step in your career with our experience-based curriculum. Manage more than $1M in assets with the Student Managed Investment Fund.

Earn your degree on your own terms. Attend the program part-time or full-time, depending on your work and life demands. The average completion time is three semesters.

Gain real-world experience in securities analysis and portfolio management through our Student Managed Investment Fund.

Why get an MS in Finance at Kogod?

Prime Location in the Nation's Capital

As the oldest business school in Washington, DC, our program has been a vibrant part of the city's financial community. You'll have access to rich networking, internship, and employment opportunities across all sectors of the financial industry.

Professional Certification Preparation

Our curriculum is focused on tangible outcomes. Our classes will prepare you for the CFA (Chartered Financial Analyst), CAIA (Chartered Alternative Investments Analyst), CFP (Certified Financial Planner), and FRM (Financial Risk Manager) exams.

Experiential Learning

Our small class sizes center around the applied practical skills you will face in real-world scenarios. You'll also have the opportunity to participate in the Student Managed Investment Fund or use our cutting-edge Financial Services and IT Lab as your virtual trading floor.

An Islamic finance certificate is a valuable complement to your MS in finance degree. As Islamic finance becomes more mainstream in major financial markets, graduates with an understanding of the field will be valuable consultants and employees.

The MS in finance consists of 33 credit hours. Our flexible curriculum means you can take specialized courses to succeed in specific careers like governance, risk management, corporate finance, and more.

Personalized Plan

Students take Introduction to Finance the week before the term begins. This gives them a solid understanding of basic financial concepts they will revisit in later courses. The rest of the curriculum is divided into 12 credit hours in core courses and 21 credit hours in electives. We offer a wide variety of electives ranging from investment banking, financial analysis, risk management, and more so you can customize your plan of studies.

Practical Experience

One of our most sought-after electives is the Student Managed Investment Fund course, a collaborative class that provides valuable, real-time experiential learning in securities analysis and portfolio management. This is your chance to oversee more than $1M in assets.

You'll Walk Away With

- Institutional Framework—understanding of the purpose and characteristics of evolving financial markets, and the role that institutions play in capital formation and allocation; ability to identify and explain the function of the major financial instruments.

-

Data Analysis Skills—ability to explain and use appropriately sophisticated analytical and econometric techniques to analyze financial data.

-

Valuation Skills—ability to describe and apply financial valuation techniques in areas, such as corporate valuation, individual equities, and/or fixed-income securities.

-

Teamwork and Communication—participate in working teams and construct effective, clear, and well-written financial analyses.

MS in finance students will be particularly well-positioned in the highly competitive real estate industry with our graduate certificate in real estate. The professionally managed global real estate investment market is worth trillions of dollars, and with the in-depth operational and financial knowledge you’ll learn in Kogod's finance program, you’ll be primed to make your mark in the field.

Student Managed Investment Fund

Gain real-world experience in securities analysis and portfolio management through our Student Managed Investment Fund. Students mimic the structure of an asset management team and oversee $1M+ worth of assets throughout the semester.

Financial Services and IT Lab

Learn about and apply the cutting-edge technology that finance professionals work with every day in our Financial Services and IT Lab. In addition to training and workshops, you can also use it as your virtual trading room.

STEM-Designated Specialization

Our STEM-designated finance program is available to graduate finance students who are accepted into the finance analytics specialization and complete four courses that are specific to the STEM designation. The designation may allow F-1 international students to apply for a 24-month extension of their Optional Practical Training, granting them the ability to work in the US for up to three years in their major field of study.

Graduate Certificate in Real Estate

Complement your studies with a graduate certificate in real estate, designed for new and current real estate managers seeking to advance in the field. Complete the certificate with an additional 6-12 credits.

Dedicated Faculty

Our faculty are renowned experts in their field and continue to lead national firms. As mentors, they are invested in the professional and academic success of our students.

CFA and CAIA Affiliation

Our partnership with CFA and CAIA grants you access to career resources, networking events, scholarship opportunities for reduced exam fees, and more.

During a recent alumni event, Kogod professors Robin Lumsdaine and Jeff Harris discussed the popular trading app Robinhood and the implications of its decision to halt GameStop trades for a day back in February. Find out more about their analysis of the situation and what they think it says about the market for the future.

*Black = Black or African American; Hispanic = Hispanic/American or Latino; AIAN = American Indian or Alaska Native; NHPI = Native Hawaiian and Other Pacific Islander.

Jerry comes to Kogod from Miami, Florida, and earned his undergraduate degree in sports management from the University of Florida. Jerry was drawn to Kogod due to its location in the nation’s capital and its reputation for a rigorous curriculum and world-class faculty.e says,“The Kogod brand will set me apart in the market as it signals excellence and achievement and is highly respected across industries.” Following his graduation, Jerry plans to work as a wealth management advisor. Learn more about Jerry’s time at Kogod by scheduling a meeting with him!

Daniel is from Ghana, and holds a bachelor’s degree in biological science from the University of Ghana. As a chartered banker, he hopes to become a chief financial officer in a conglomerate and ultimately an industry leader in the profession. He chose Kogod to help him meet his goal as it has a globally renowned finance program that leverages the use of modern technology and tools to prepare its students for the future. Schedule a one-on-one meeting with Daniel to learn more about his Kogod experience!

Our graduates have found professional success in a wide variety of sectors in the financial industry. Six months after graduation, 94 percent of our students report they are either fully employed, in graduate school, or both.

Our alumni pursue jobs in:

- Asset management

- Real estate finance

- Commercial banking

- Corporate finance

- Financial regulation

- Investment banking

- Development banking

Recent employers include:

- Capital One

- Freddie Mac

- Sun Trust Bank

- TIAA

- The World Bank

- Cambridge Associates

- Merril Lynch

- Bloomberg LP

- Deloitte

- The Carlyle Group

Recent Finance News

Independent interviewed Professor Caroline Bruckner.

Kogod Professor Octavian Ionici offers an expert opinion in a WalletHub article.

Professor Tharindra Ranasinghe's co-authored paper was published in the Journal of Financial and...

American University’s Kogod School of Business welcomes two new professors whose expertise in...

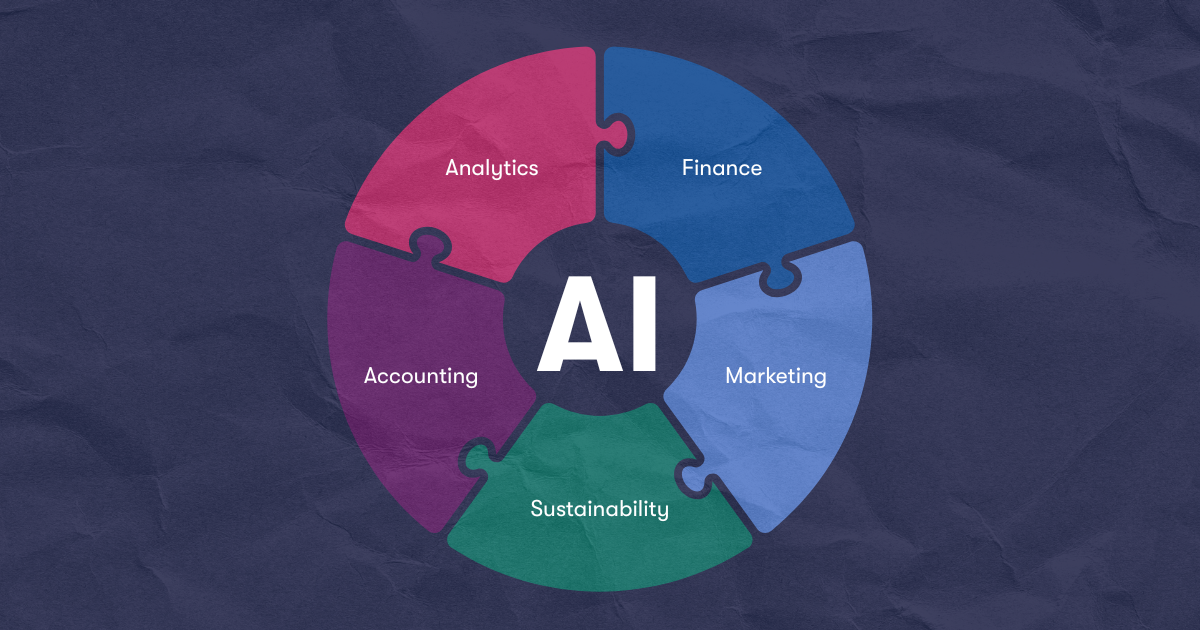

As artificial intelligence rapidly transforms industries from finance to sustainability, the Kogod...

The Kogod School of Business provides you with the tools to best harness AI tools, no matter what...

Join Kogod graduate student Gabby Vella as she takes you through some of her favorite places in the nation's capital.

Upcoming Admissions Events

Interested in grad school but don't know where to start? We can help! Learn more about the different programs Kogod has to offer, and find the right fit for you. This is a live webinar, and you will be able to ask questions. Register Now

The MS in Finance program at the Kogod School of Business is designed to prepare graduates for a variety of jobs in the finance industry. Join Prof. Ali Sanati and Kogod Admissions as they take you through the curriculum and answer any questions you have about applying. Register Now

Applying to graduate school can be confusing. Let us help! Join our Kogod Graduate Admissions team for an informational overview covering application deadlines, requirements, and timelines. This will be a live session and attendees are welcome to ask questions during the program. Register Now

Interested in grad school but don't know where to start? We can help! Learn more about the different programs Kogod has to offer, and find the right fit for you. This is a live webinar, and you will be able to ask questions. Register Now

Applying to graduate school can be confusing. Let us help! Join our Kogod Graduate Admissions team for an informational overview covering application deadlines, requirements, and timelines. This will be a live session and attendees are welcome to ask questions during the program. Register Now

Kogod is best experienced in person! Please join us to preview the student experience of our on-campus and online programs. We have a whole day planned with activities and events to connect you with our faculty, staff, current students, and alumni. From mock classes to an exclusive evening reception, this will be an event you don't want to miss. Register Now

4400 Massachusetts Avenue, NW

Washington, DC 20016

Copyright © 2026 American University.