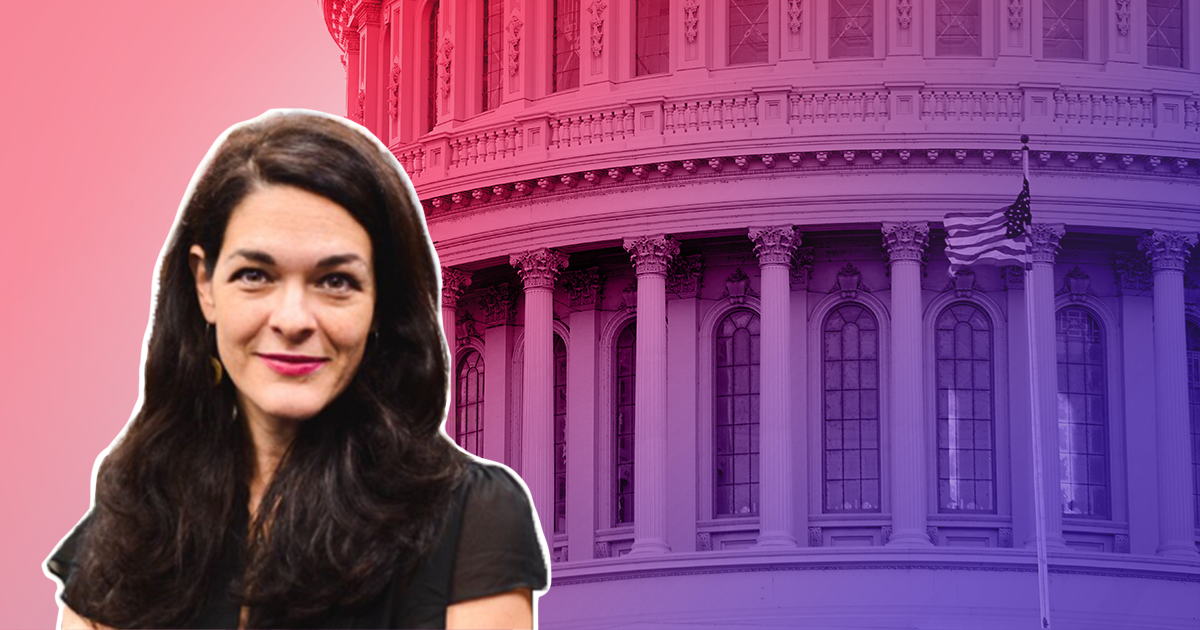

Caroline Bruckner

Managing Director, Kogod Tax Policy Center

Caroline Bruckner, Kogod School of Business professor of accounting and managing director of the Kogod Tax Policy Center, prepared and sent the following statement for the record to the United States House of Representatives Committee on Small Business. The statement was submitted in conjunction with the committee's April 18 hearing, titled "Paying Their Fair Share: How Tax Hikes Crush the Competitiveness of Small Businesses," and discusses findings and recommendations from Bruckner's research, The Small Business Tax Literacy Project.

Chair Williams, Ranking Member Velázquez , U.S. Senate Committee on Small Business (the “Committee”) Members and Staff, thank you for holding a full committee hearing on April 18, 2023, titled, “Paying Their Fair Share: How Tax Hikes Crush Small Business Competitiveness.” My name is Caroline Bruckner and I am a tax professor on the faculty at American University Kogod School of Business. I also serve as the Managing Director of the Kogod Tax Policy Center (KTPC), which conducts non-partisan policy research on tax and compliance issues specific to small businesses and entrepreneurs. The KTPC’s mission is to develop and analyze research and policy recommendations for tax-related problems faced by small businesses, and to promote public dialogue concerning tax issues critical to small businesses and entrepreneurs.

Since 2015, I have focused our research agenda, in part, on the tax and compliance issues impacting self-employed small business owners and women business owners, the overwhelming majority of which are small businesses, as well as the need for increased tax data transparency. In connection with the April 18 hearing, I am submitting preliminary findings and recommendations from my latest research, The Small Business Tax Literacy Project (SBTLP), related to the Committee’s critical work on studying the impact of taxes on small business competitiveness and efforts to engage in effective policymaking and oversight with respect to small business tax expenditures.

1. The Small Business Tax Literacy Gap Creates Additional Costs and Anxiety for Small Business Owners.

In general, tax literacy is a significant—albeit overlooked and understudied—pain point of small business owners. Since 2016, the KTPC has developed research and testified before this Committee on how millions of small business owners struggle to meet their tax filing obligations and don’t know how to comply with tax rules. For our latest research on small business tax literacy, we partnered with Bárbara Robles, retired former Principal Economist with the Federal Reserve Board in Washington, D.C., and Public Private Strategies Institute (PPSI) to develop and administer a unique 20-question survey that builds on prior public and private sector tax compliance and financial literacy surveys and captures key demographic information to gauge tax literacy of small businesses and the independent workforce. Our topline findings reflect the fact that too many small businesses are struggling with their taxes and are a good starting place for this Committee to develop actionable outreach, education and tax assistance strategies for helping small businesses navigate the complexities of the U.S. tax code. Specifically, our survey respondents reported that:

- It’s a Pay-to-Pay System: 87% hired someone or bought software to do their taxes;

- A College Degree Doesn’t Guarantee You Know How to Do Your Taxes: while 76% had at least a college degree (compared to 23.5% of the U.S. population), only 13.5% of our respondents learned how to do taxes in college and only 7.5% reported learning how to do taxes in high school;

- You’re On Your Own When It Comes to Taxes: 62% reported learning how to do taxes on their own;

- Small Businesses Don’t Know What’s Due When: Approximately one-third didn’t know whether they needed to pay quarterly-estimated taxes and 25% didn’t know how to pay their taxes. While 54% of our respondents did set aside money to pay taxes, 30% didn’t know if they would own money and didn’t set aside money to pay taxes; and

- Tax Time Triggers Anxiety: Over 37% felt nervous/scared or bad about filing taxes.

Compounding these challenges is that fact that more than one-third of respondents reported that they never or only sometimes received tax forms from businesses that engaged them. These initial SBTLP survey results strongly indicate that small business owners are both unprepared and unnecessarily challenged in trying to comply with the complexities of the U.S. tax system. It’s not just tax rates that crush small business competitiveness, it’s a lack of understanding on what’s due when and how to file, and ultimately having to spend money to pay taxes. Moreover, existing research on the growth of small businesses in recent years suggests that the tax challenges captured in SBTLP survey results have and are going to continue to grow exponentially.

2. The Growing Small Business Tax Literacy Gap Contributes to the Tax Gap

In recent years, more and more Americans are supplementing their incomes by working outside of traditional employment. This is a trend that tax data research has documented. Following the onset of the COVID-19 pandemic, private sector research has found that the trend for independent work has even accelerated. For example, in 2022, MBO Partners found that the number of independent workers, “soared” by 26% to 64.4 million, which was up from 51.1 million in 2021. This notable increase followed 2021’s “unprecedented” 34% year-over-year increase. In addition, a McKinsey report from last year confirmed that “[i]n the latest iteration of McKinsey’s American Opportunity Survey, a remarkable 36 percent of employed respondents—equivalent to 58 million Americans when extrapolated from the representative sample—identify as independent workers.” But it’s not just individuals working for themselves outside of traditional employment. Since 2020, small business establishment data shows the number of new firms has “risen at a historic rate.” While the independent workforce and number of small business owners has grown, there has not been a corresponding effort to promote small business tax education to prepare these new business owners for the tax challenges they face.

Although extensive research has been done to show that financial education has become a significant factor in preparing the next generation of work-for-pay labor market participants and at least 26 states require some financial literacy training for high school graduation, a review of the financial education curriculum for high school and beyond displays a disturbing gap in preparing young and work-age labor market entrants as well as early-stage entrepreneurs for meeting their tax compliance obligations and accessing capital through tax savings as they engage in a variety of income generating activities.

The growing small business tax literacy gap has quantifiable implications for the tax gap, which is the difference between the amount of tax imposed by law and that which is ultimately collected. Last year, IRS published its latest estimate of the gross annual tax gap for the 2014–2016 tax years and found it to be $496 billion, which was comprised of (1) nonfiling ($39 billion), (2) underreporting ($398 billion), and (3) underpayment ($59 billion). Of that $398B underreporting tax gap, IRS estimated individuals failing to report all of their business income to be $130 billion (26%), and individuals failing to correctly report their self-employment taxes estimated to be $53 billion (11%). Overall, the IRS estimated underreported nonfarm proprietor income to be approx. $126 billion. While these estimates indicate that small businesses contribute to the tax gap, they don’t explain why. Based on the latest SBTLP survey results, there’s no question poor small business tax literacy contributes to the tax gap. In addition, other KTPC research has found that small businesses struggle to comply with tax filing obligations because the current tax administration system is not designed to facilitate compliance for the independent workforce, and this, in turn, contributes to the tax gap and shortfalls in retirement savings. Consequently, prioritizing closing the small business tax literacy gap is one way that Congress and IRS can help small businesses access capital through tax savings and work to close the growing tax gap.

3. Recommendations for Closing the Small Business Tax Literacy Gap

While this Committee does not have jurisdiction over tax matters specifically, this Committee does have small business outreach expertise and oversight of the U.S. Small Business Administration (SBA), and can engage constructively with IRS, SBA and other federal agencies that have financing programs targeted specifically to small businesses. As a result, this Committee is uniquely positioned to aid and educate small businesses on tax issues and advise IRS and SBA on outreach, education and assistance strategies targeting small business tax literacy. To that end, I recommend this Committee engage with IRS and other federal agencies to prioritize small business tax education initiatives. Specifically, this Committee should take steps to recommend:

- IRS prioritize outreach and education of small business owners and the independent workforce by forming a small business tax information and training coalition together with SBA, U.S. Department of Agriculture, U.S. Department of Commerce and other agencies with small business financing programs. The coalition’s main charter should be promoting small business tax education to facilitate compliance and access capital through tax savings.

- IRS expand Volunteer Income Tax Assistance (VITA) program recruiting through SBA’s network of programs (e.g., Small Business Development Centers; Women’s Business Centers; SCORE) and other small business financing networks (e.g., CDFI networks) as well as high schools, community colleges and university students. For example, IRS could develop “VITA Volunteer Corps” certifications together with targeting existing volunteer organizations for VITA recruiting (e.g., Americorps/SCORE volunteers).

- Together with IRS, SBA develop small business and independent workforce tax literacy modules for inclusion in financial literacy and civics curricula/courses developed for SBA programs, including those prepared and distributed among SBA’s networks and programs as well as K-12, High School and University programs.

Going forward, IRS/SBA should collaborate on funding and employing participatory research and tax awareness and education as a wholistic methodology for learning what type and level of tax literacy has the most significant impact on small business access to capital and facilitates compliance.

4. The Ongoing Need for Tax Data Transparency and Small Business Tax Expenditures.

Finally, this Committee should engage with IRS, SBA’s Office of Advocacy and other federal agencies to develop inclusive tax data and research. The U.S. tax system reflects racial, ethnic and gender bias and “adds to inequality in this country.” The pervasive nature of the bias in the U.S. tax system is compounded by the fact that for the most part, civil rights protections and data transparency guardrails that require federal agencies to collect data on beneficiaries of federally-funded programs don’t expressly apply to “tax expenditures” (i.e., the special provisions that provide some taxpayers “more favorable treatment than regular income tax”). In other words, civil rights laws don’t mandate Treasury or IRS collect demographic data on who benefits from tax expenditures. So, for example, while federal and state housing agencies are required to track and publish data on the race, ethnicity, family composition, age, income, use of rental assistance, disability status, and monthly rental payments of households residing in low-income housing tax credit properties, neither Treasury nor the Committee has any idea of what the equity implications are for the corporations that are profiting from them.

In recent decades, Congress has increasingly turned to tax expenditures to deliver critical anti-poverty, health care or housing programming for taxpayers or to stimulate business activity through deductions for accelerated depreciation and individuals with business income. As you know, for budget purposes, tax expenditures are similar to direct spending programs that function as entitlements. However, the absence of inclusive demographic data on taxpayers that claim tax expenditures raises both equity issues and oversight challenges for Congress. How can Congress know if the programs funded through the U.S. tax code are working as intended if they don’t track who benefits? How can the Committee effectively conduct its oversight function of these “entitlement” programs absent inclusive tax data?

Notwithstanding these challenges, legal researchers have been using data from the private sector and federal agencies—other than IRS—to estimate the discriminatory racial and gender implications for various tax expenditures. Economists and members of Congress have been increasingly insistent on the need for additional research and demographic data on how taxpayers benefit from—or are penalized by—different tax provisions and administrative policies. Recently, researchers at Treasury and IRS are stepping up and working to enable tax expenditure data transparency. However, Congress needs to do its part and incorporate and normalize the use of inclusive tax data in the legislative process. In connection with this, the Committee should work with Treasury and the Joint Committee on Taxation to include demographic distribution data when preparing estimates of small business tax expenditures in connection with the work on improving tax policy for small business owners. Updating small business tax expenditures to make smarter, equitable investments in the small businesses who will grow our economy is a vital function of this Committee.

Again, thank you to the Committee for holding this important hearing. I stand ready to help the Committee with its work. Feel welcome to contact me with questions regarding the foregoing.