.png)

Sharon Wanyana, Aikokul Abdivalieva, Conrad Linus Muhirwe, and Mathias Ndungu

MS in Analytics Students, Kogod School of Business

Introduction

Fast fashion has transformed global apparel consumption, making trendy clothing widely accessible. However, its rapid production cycles have intensified an environmental crisis, with the United Nations Environment Programme (UNEP) reporting that a truckload of clothing waste is incinerated or landfilled every second. In response to growing scrutiny, industry leaders like Zara introduced sustainability initiatives, notably the “Join Life” label in 2015, to reduce their ecological footprint.

This article examines Zara’s “Join Life” initiative as a case study to evaluate the feasibility of integrating sustainability into fast fashion without compromising profitability. By analyzing a dataset of 277 items from Zara’s 2020 Spanish catalog, the study investigates key factors such as material composition, pricing strategies, and waste minimization efforts. The findings offer insights into both the opportunities and limitations of fast fashion’s transition toward sustainability, providing a broader perspective on the industry's ongoing shift toward more responsible production practices.

Disclaimer

The analysis presented in this article is based on data from 2020, and the comparative industry information is as of 2020–2024. While sustainability efforts, corporate initiatives, and regulatory frameworks continue to evolve, key industry trends such as the tension between profitability and environmental responsibility have remained central to the fast fashion debate. Additionally, Zara’s 2020 sustainability initiatives serve as a benchmark for assessing the feasibility of long-term environmental commitments in the industry. However, given the evolving landscape of sustainability initiatives and regulations, subsequent changes in company policies and material composition may not be reflected in this study. Future research should prioritize obtaining more current data to provide updated insights into the ongoing developments in sustainable fashion.

The Environmental Challenge of Fast Fashion

Fast fashion’s economic model relies on low-cost production, rapid turnover, and disposable consumption patterns—factors that exacerbate environmental degradation. The industry’s reliance on synthetic textiles, excessive water consumption, and inadequate waste management has intensified ecological concerns. For instance, in Ghana’s Kantamanto Market, approximately 40 percent of the 15 million garments each week are deemed waste, contaminating water systems and posing health hazards to local communities. This large-scale waste problem underscores the challenge brands face in balancing profitability with sustainability, while fast fashion thrives on affordability and high sales volume, the environmental consequences of overproduction and short product lifecycles highlight the urgent need for more sustainable business models. As regulatory frameworks evolve and consumer sentiment shifts towards sustainability, brands must navigate a paradigm shift that necessitates an equilibrium between cost efficiency and environmental stewardship.

Insights

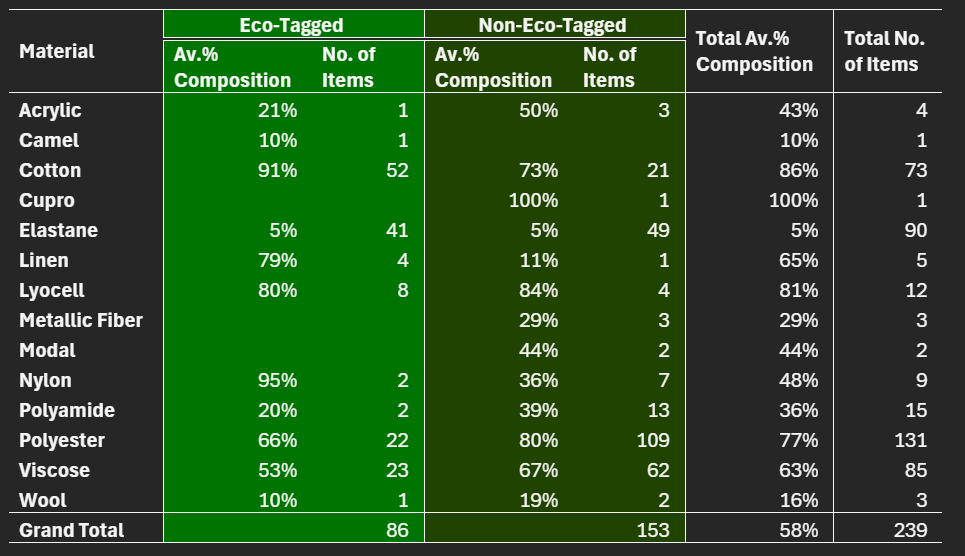

- Eco-Tagged items constituted 36 percent of Zara’s inventory, with cotton being the most frequently used material, present in 52 items at an average composition of 91 percent, followed by elastane in 41 items at 5 percent. Notably, nylon had a high average composition of 95 percent, though it appeared in only two items. In contrast, Non-Eco-Tagged items relied more on synthetic fibers, with polyester being the most prevalent, found in 109 items at an average composition of 80 percent, followed by viscose in 62 items at 67 percent. Additionally, cupro had the highest average composition at 100 percent, though it was present in only one item. This distinction highlights that while Eco-Tagged items favor biodegradable materials like cotton, yet they still include some synthetics. Non-Eco-Tagged items, however, are dominated by high-percentage synthetics like polyester, despite also incorporating semi-synthetics like viscose and cupro.

- Contrary to conventional assumptions, Eco-Tagged items were priced €5.14 lower on average than Non-Eco-Tagged items. This finding suggests that sustainability initiatives do not inherently lead to higher consumer costs. The lower pricing may reflect Zara’s strategic decision to promote its sustainable line competitively or a cost advantage from using widely available biodegradable materials like cotton and lyocell. Additionally, Non-Eco-Tagged items may incorporate costlier synthetic blends, specialized finishes like metallic embellishments, or processing methods that contribute to higher pricing. This pricing contrast indicates that sustainability can serve as both a market-driven approach and a cost-effective alternative within Zara’s supply chain.

- Regression modeling demonstrated that material composition, particularly the inclusion of cupro and metallic fibers, significantly influenced pricing variability, underscoring the strategic role of material selection in sustainable product development.

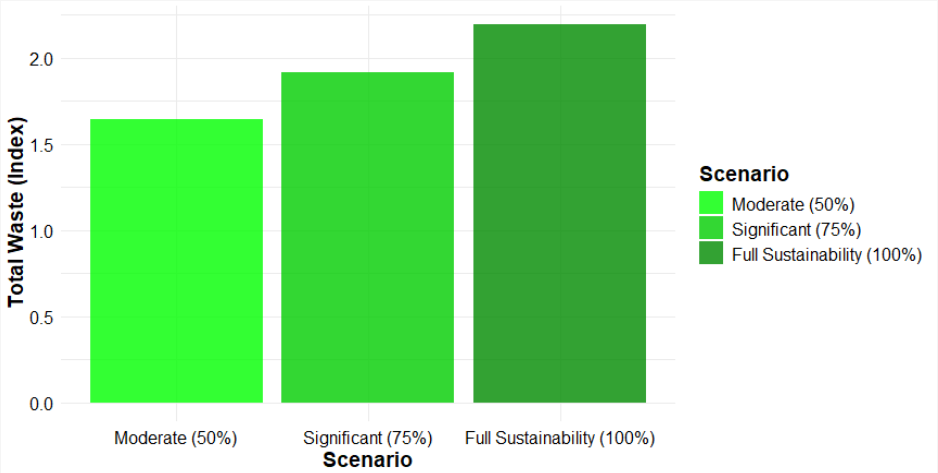

Scenario modeling assessed Zara’s potential for waste minimization by increasing Eco-Tagged items in its catalog. The waste index was calculated by combining material composition proportions with assigned waste factors (1.0 for synthetics, 0.5 for semi-synthetics, and 0.25 for naturals). This index was then used to evaluate three scenarios: Moderate (50 percent), Significant (75 percent), and Full Sustainability (100 percent) adoption of Eco-Tagged items. Paradoxically, higher adoption of Eco-Tagged items increased the waste index due to the greater presence of semi-synthetics like modal and viscose. These materials, though marketed as sustainable, require chemical-intensive processing, degrade slower than natural fibers, and are difficult to recycle due to fiber blending. This highlights the need to prioritize fully biodegradable or easily recyclable materials over simply expanding Eco-Tagged product lines.

Comparative Analysis: Zara and Industry Leaders

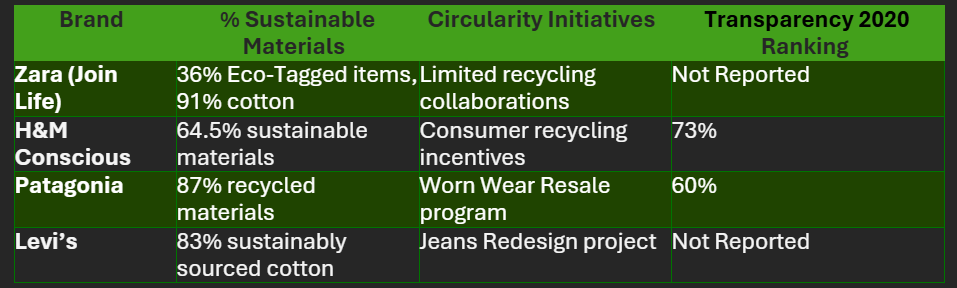

Benchmarking Zara’s sustainability trajectory against H&M and Patagonia illuminates both strengths and deficiencies:

While Zara has made strides in material sustainability and pricing accessibility, the brand lags in transparency and circular economy initiatives. The research highlights how material composition and sourcing strategies are critical to aligning profitability with sustainability, yet challenges persist in ensuring supply chain-wide adoption of sustainable practices. Additionally, sustainability extends beyond environmental factors to include ethical production practices, such as fair labor conditions and worker rights, areas where greater transparency and commitment are needed to achieve a truly sustainable business model.

Challenges in Sustainability Implementation

The research identified several key challenges in advancing sustainable fashion within Zara’s model:

1. Material Composition Trade-offs. Zara has made progress in incorporating sustainable materials through its "Join Life" initiative, which identifies products made with environmentally friendly raw materials, such as organic cotton and recycled fabrics. As of February 2023, 60 percent of Zara's collection carried this designation, reflecting a significant commitment to sustainable sourcing. However, the reliance on semi-synthetic materials like modal and viscose in these Eco-Tagged items has raised concerns.

While these materials are often marketed as sustainable alternatives, their production processes can be resource-intensive and environmentally taxing. For instance, the manufacturing of viscose involves chemical treatments that may lead to environmental pollution if not managed properly.

This paradox highlights the need for a more refined approach to material selection, prioritizing sustainable options that minimize environmental impact throughout their lifecycle.

2. Transparency Gaps. Transparency in sustainability reporting is critical for assessing a company's environmental and social impact. While Zara's parent company, Inditex, publishes annual reports detailing sustainability goals and progress, Zara itself does not release standalone sustainability reports. This lack of brand-specific data makes it challenging to evaluate Zara's direct impact and progress. In contrast, competitors like H&M and Patagonia provide detailed sustainability reports with measurable targets and progress updates. H&M, for example, offers comprehensive insights into its sustainability initiatives, including goals for sustainable material sourcing and circular fashion efforts. Patagonia goes further by empowering customers to repair their clothes instead of buying new ones, fostering a culture of sustainability and responsible consumption.

This disparity in transparency can hinder stakeholders' ability to hold Zara accountable and assess its true commitment to sustainability.

3. Limited Circularity Initiatives Circularity initiatives, such as take-back programs and resale platforms, are vital for reducing textile waste and promoting sustainable consumption. Zara has recently launched "Zara Pre-Owned," a platform that allows customers to repair, resell, or donate their used garments. Initially launched in the UK in November 2022, this service is expanding to other markets, including the United States by the end of October 2024.

While this is a positive development, Zara's circularity efforts are still in the early stages compared to competitors. H&M, for instance, has established extensive garment collection programs and collaborates with recycling partners to process collected textiles. Patagonia's "Worn Wear" program not only resells used clothing but also educates consumers on garment care and repair, thereby extending product lifespans and reducing the need for new purchases.

To enhance its circularity efforts, Zara could expand its take-back programs, invest in textile recycling technologies, and engage consumers in sustainability education. These steps would align with industry best practices and demonstrate a deeper commitment to environmental stewardship.

Strategic Recommendations

To cultivate a sustainability model that aligns environmental imperatives with commercial viability, fast fashion firms should prioritize the following actions:

1. Refine Material Sourcing Strategies. Prioritizing fully biodegradable and circular materials is essential to curtail textile waste while maintaining competitive pricing structures. For example, H&M has committed to using 100 percent recycled or sustainably sourced materials by 2023,offering products made from organic cotton and recycled polyester. Similarly, Gabriela Hearst introduced compostable bio-plastics for packaging and staged a carbon-neutral fashion show, showcasing innovative approaches to sustainability.

2. Enhance Transparency Mechanisms. Implementing standardized sustainability reporting frameworks fosters consumer trust and accountability. Desigual, for instance, publicly disclosed its list of garment factories and conducts independent audits to ensure compliance with its Code of Conduct, enhancing transparency in its supply chain. Ganni partnered with transparency tech providers to trace garment origins, allowing customers to access information about the production process.

3. Expand Circular Economy Initiatives. Developing comprehensive resale and textile recycling programs extends product lifecycles and reduces waste. H&M launched a global garment collecting initiative, offering customers vouchers in exchange for used clothing, which is then recycled or repurposed. Gabriela Hearst collaborated with Eon to provide digital identities for garments, offering transparency about each item's origin and facilitating recycling.

4. Strengthen Supply Chain Collaboration. Engaging suppliers in sustainability training and incentivizing the adoption of eco-friendly production practices is equally important. Puma implemented a supply chain finance scheme linking sustainability performance to financing costs, rewarding suppliers who adopt eco-friendly practices with better financial terms. Additionally, major corporations like Walmart offer favorable financing to suppliers through partnerships with banks like HSBC, encouraging sustainable practices.

5. Improve Accessibility to Data for Future Research. Publicly disclosing more frequent and detailed sustainability reports enables accurate assessments of ongoing initiatives. H&M publishes annual sustainability performance reports detailing their progress and challenges, providing valuable data for researchers and stakeholders. Desigual also releases sustainability reports outlining their environmental impact and efforts to reduce greenhouse gas emissions.

References

Badell, Ana Marrodan and Mireia Solanich Ventura. Fast Fashion Eco Commitment Dataset. 8 November 2020. <https://zenodo.org/records/4261101>.

Change Oracle. Business and Economics, Leadership. 10 September 2021. <https://changeoracle.com/2021/09/10/10-reasons-why-patagonia-is-worlds-most/>.

Circ. Circ. 15 August 2024. <https://circ.earth/zara-and-circ-continue-partnership-with-new-collection-made-from-recycled-polycotton-blended-textiles/>.

Desigual. n.d. <https://www.desigual.com/on/demandware.static/-/Library-Sites-DsglSharedLibrary/default/dwd3e345d7/docs/corporate/LoveTheWorld/Corporate_DesigualSuppliers_2020_EN.pdf>.

Eon. n.d. 13 March 2025. <https://www.eon.xyz/clients/gabriela-hearst>.

Falk, Yassine. infomineo. 29 August 2023. <https://infomineo.com/sustainable-development/the-state-of-sustainability-in-the-fashion-industry/>.

Gabriela Hearst. n.d. 13 March 2025. <https://gabrielahearst.com/blogs/stories/carbon-neutral-show?srsltid=AfmBOoqFPvt6ug0qmCBRnjfVI5S1ouVJRWxlFIgfpis8QZ0nZCJd-VNF>.

H & M Group. Circularity. n.d. 2 December 2024. <https://hmgroup.com/sustainability/circularity-and-climate/circularity/>.

—. hmgroup. n.d. 13 March 2025. <https://hmgroup.com/sustainability/circularity-and-climate/materials/#:~:text=All%20materials%20have%20an%20impact,30%25%20recycled%20materials%20by%202025.>.

—. "Sustainability Performance Report 2020." 22 March 2021. hmgroup. Document. <https://hmgroup.com/wp-content/uploads/2021/03/HM-Group-Sustainability-Performance-Report-2020.pdf>.

Hogue, Jeff. Sustainability. 21 July 2021. <https://www.levistrauss.com/2021/07/21/designing-a-more-circular-future/>.

Index, The Fashion Transparency. "Fashion Transparency Index 2020 ranks fashion brands & retailers on social & environmental issues; Finds majority of brands lack transparency." 2020. <https://www.business-humanrights.org/en/latest-news/fashion-transparency-index-2020-ranks-fashion-brands-retailers-on-social-environmental-issues-finds-majority-of-brands-lack-transparency/>.

Marc, Jenny. Global Connections. 14 August 2023. <https://www.cnn.com/2023/08/10/africa/kantamanto-textile-market-ghana-or-foundation-spc-intl/index.html>.

Pons, Corina. Reuters. 10 October 2024. <https://www.reuters.com/sustainability/spains-top-fashion-retailers-launch-trial-collect-clothes-waste-2025-2024-10-10/>.

UN Global Compact. "Communication on Progress." November 2021. UN Global Compact. <https://unglobalcompact.org/participation/report/cop/active/459677>.

UNEP. UN Environmental Programme. 24 November 2022. <https://www.unep.org/news-and-stories/story/environmental-costs-fast-fashion>.

Worland, Justin. Time. 11 October 2024. <https://time.com/7086071/supply-chain-decarbonization/>.

Worn Wear. n.d. 2 December 2024. <https://wornwear.patagonia.com/>.

Zara. JOIN LIFE. n.d. 12 March 2025. <https://www.zara.com>.

Zara Sustainability Report. n.d. 13 March 2025. <https://impakter.com/index/zara-sustainability-report/>.

Zwieglinska, Zofia. Glossy. 6 December 2021. <https://www.glossy.co/fashion/how-ganni-is-delivering-supply-chain-transparency/>.