Bhagyashree More, Erica Chiorazzi, Karen Campos, Stephen Minor, Kelsey Murlless, and Allyson Dilorenzo

Introduction

Understanding and navigating the complexities of global supply chains is essential in the journey toward sustainability and circularity within the fashion industry. Supply chain emissions in the apparel sector account for at least 80 percent of its total carbon footprint (World Economic Forum, 2021). Given the geographic dispersion of these supply chains, focusing on Scope 3 emission reductions—often involving external suppliers—are the most difficult to tackle and can greatly accelerate progress toward sustainability goals, particularly in regions with limited technological availability and regulatory pressures. Prioritizing supplier engagement enhances a brand's strategy, strengthens its reputation, reduces legal risks, mitigates climate impact, and aligns with shareholder expectations. There is already substantial progress as leading fashion companies are increasingly investing in sustainable materials, renewable energy, and energy efficiency to decarbonize their supply chains and improve overall strategy.

In the pursuit of a circular economy and net-zero ambitions, fashion brands must address emissions not only from their direct operations (Scope 1) and purchased electricity (Scope 2) but also from broader supply chain activities (Scope 3). Scope 3 emissions are challenging to manage as they occur outside the company’s direct control. Setting a Scope 3 reduction target indicates a commitment to managing indirect emissions and working collaboratively with suppliers to reduce the brand’s overall carbon footprint. Engaging suppliers is thus crucial for advancing Scope 3 goals and achieving comprehensive decarbonization.

Through initiatives such as the Climate Solutions Partnership (CSP), students in the Sustainability Management program at the Kogod School of Business, collaborated with the World Resources Institute (WRI) and partners under the Clean Energy Investment Accelerator (CEIA) to map barriers and common strategies for sustainable fashion brands aiming to decarbonize their supply chains. Brands such as Arc’teryx, Columbia, H&M Group, Icebug, NEMO, and Nike shared best practices on supplier engagement, renewable energy adoption, and energy efficiency improvements, forming a roadmap of tools and practices for other industry players committed to sustainability.

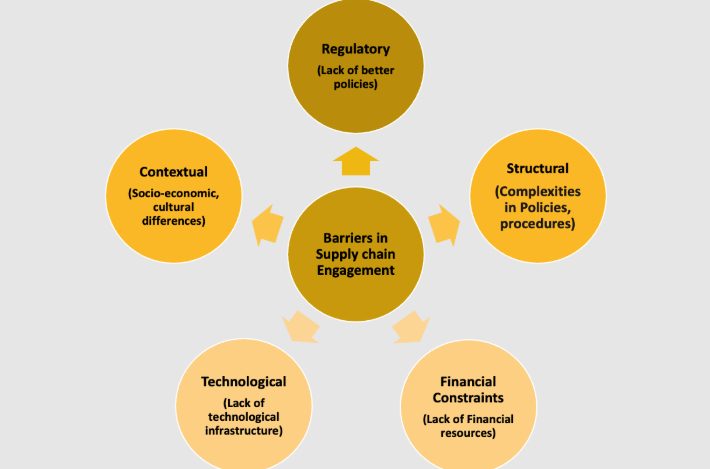

Companies seeking to engage with their suppliers, with the motive to have their supply chain align with their internal emissions reduction targets, face multiple barriers. These barriers can be contextual, structural, regulatory, technological, and financial in nature. Our survey results depict that some of the top barriers included:

- Lack of technical expertise and training

- Lack of decarbonization ambition

- High upfront investment costs for cleaner technologies

- Insufficient headcount to handle the extra workload

- Limited research, development, and innovation capabilities

Some of the contextual challenges faced by companies are socio-economic and cultural differences, language barriers, and the complexity of sustainability initiatives, such as the necessity of collaboration and integration of various disciplines, the nonlinearity of social systems, operating in the face of uncertainty and underlying risks, etc. (4)

International brands with their supply chain spread across the globe face unique challenges that differ not only by region but also by the tier of suppliers: Tier 1 (direct suppliers), Tier 2 (subcontractors of Tier 1), and Tier 3 (subcontractors of Tier 2). However, with mounting pressure from the international community, key stakeholders and regulators, and peer competition, apparel companies have been strategizing to successfully engage with their suppliers to set and align their targets toward carbon emissions reduction. (5)

Capacity Building

Providing financial incentives encourages suppliers to take their next (or first) step in their decarbonization journey, but ensuring that their suppliers have the necessary skills, processes, and resources to take that step is equally important for companies. Supporting adaptive and technical capacities–through target building, operational training, audits, and external partnerships–can help drive success in local and company-wide initiatives to tackle Scope 3 emissions. (10)

Target Building

The most effective targets are transparent, whether they are broad targets, such as a percent reduction in greenhouse gas emissions per year, or more specific targets, like phasing out coal by a specific date. Individualized facility-level targets can also be established, taking into account emissions, business volume, and readiness. (11)

Meeting these targets requires ongoing effort and close monitoring. Supplier support may look like holding workshops to build upon existing industry knowledge surrounding sustainability, sharing new regulatory requirements, conducting energy efficiency audits, or holding recurring review meetings to raise awareness at all levels of production. By aligning production schedules, quality control, production costs, designs, and sustainability goals, suppliers can stay on track and make progress toward operations decarbonization. (12)

Operational Training

To meet climate goals and targets, companies must implement specific emissions-reducing targets throughout their supply chains; oftentimes requiring many hours of operational training for suppliers. Once equipped with the knowledge and skills necessary to implement sustainable practices, suppliers can more effectively reduce emissions. (13)

Columbia Apparel took an approach towards engagement by bringing on-site energy experts to provide recommendations to its suppliers."

H&M Group found value in enrolling suppliers in chemical management training for those that manage hazardous waste."

Companies like Arc’teryx took a proactive approach by directly training their suppliers on SBTi and exploring the best suited options to align their decarbonization targets."

External Partnerships

Smaller corporations aiming to work with suppliers on reducing their carbon footprint may benefit from external technical support. Third-party organizations, such as the Clean Energy Investment Accelerator (CEIA), Sustainable Apparel Coalition (SAC), Apparel Impact Institute (AII), and other programs/initiatives and various sustainability consulting agencies, offer valuable tools and information to companies seeking to reduce their GHG emissions. These organizations provide support, resources, and guidance to companies trying to achieve their emissions reduction goals. (14)

Industry coalitions such as the UN Alliance for Sustainable Fashion promote collaboration between industry members. This space creates a knowledge-sharing path to strengthen and foster new initiatives which allows brands to communicate similar messages to their suppliers. Sponsoring related plans makes it easier for suppliers to deliver on commitments to multiple brands. (15)

Swedish footwear brand, Icebug, has stood out as a leader in supply chain sustainability efforts. Icebug took part in a CEIA energy project with five North American apparel brands to pool resources and generate economies of scale. Through a CEIA-led pre-feasibility study, Icebug identified power purchase agreements (PPAs) for rooftop solar as a viable decarbonization strategy for suppliers in Vietnam. Inspired by the study, Icebug developed SOLROS for various manufacturers in Vietnam. (16) SOLROS is currently marketed to factories as a method for lowering emissions, increasing energy independence, and lowering energy costs. (17)

Icebug's SOLROS program is an excellent example of a mutually beneficial and collaborative sustainability solution for both corporations and their suppliers. (18)

Measurement and Reporting

Accurately measuring and reporting impact is critical to any and every decarbonization strategy. According to corporate champions, there are two main reporting systems: the Higg Index and internal company databases. (19)

The Higg Index was launched in 2011 by the Sustainable Apparel Coalition as a standardized measurement tool for value chain sustainability. Today, it includes data from the metrics of over 21,000 organizations, making it a powerful tool for benchmarking and comparison (Higg Index, 2022). Most corporate champions utilize the Higg Facility Environmental Module or the Higg Materials Sustainability Index (MSI) to track supplier emissions. (20)

However, it relies on self-assessment, which can introduce human error. To compensate for this limitation, companies use internal data management systems to track environmental metrics. While these systems vary in complexity, they all provide brand control over emission metrics. In some cases, companies use email correspondence with information requests to individually engage with suppliers and measure progress toward decarbonization goals. (21)

Annual reporting of energy data is most common, but some suppliers are asked to update companies [“buyers”] with quarterly or monthly reports. The frequency of reporting depends on a variety of factors, including (but not limited to) ongoing energy projects, fluctuating production levels, and supply chain challenges. (22)

Financial Incentives

It’s no secret that the path to net-zero emissions requires significant financing. The costs of long payback periods associated with decarbonization investments are so high that even the most significant and wealthiest companies sometimes struggle to pay the price. By providing incentives for suppliers to join companies on the road to decarbonization, emissions can be reduced while simultaneously alleviating financial burdens. (6)

Some corporate leaders realized that they could take ownership of sustainability initiatives within their supply chain by covering the entire or partial costs of developing carbon reduction plans for their suppliers. Other corporations have created a dedicated sustainability budget for their suppliers. (7)

H&M Group, a Swedish clothing giant, emerged as a leader in supply chain decarbonization through its “Green Fashion Initiative,” where suppliers develop a proposal in response to a Request for Proposals detailing specific steps to reduce fossil fuel consumption within their operations. These proposals are verified and evaluated for feasibility, and if H&M approves the application, suppliers gain access to company funding to implement the decarbonization strategies. (8)

By incentivizing engagement, H&M takes a hands-on approach and obtains a blueprint for its suppliers’ decarbonization initiatives."

Bhagyashree More, Erica Chiorazzi, Karen Campos, Stephen Minor, Kelsey Murlless, and Allyson Dilorenzo

MS in Sustainability Management Students, Kogod School of Business

Through this innovative approach, and incorporating financial incentives, H&M is increasing supply chain resilience while making it easier for its suppliers to comply. (9)

Conclusion

Decarbonizing supply chains can be a complex task with no universal solution. Therefore, developing customized strategies tailored to specific circumstances, operations, and even geographic locations is vital to achieving corporate decarbonization goals (23).

Despite challenges and barriers, replicating sustainable practices is feasible for both big and smaller brands. While there is no one-size-fits-all approach, there are several strategies that can be used to help any brand on its path toward sustainability. For example, securing data is accessible and reliable through tools like the Higg Facility Environment Module (FEM), and corporates can eventually pair tools with capacity-building initiatives such as workshops and seminars to set attainable targets. Technical and financial support are also crucial components of this process. One excellent example of both tools is the CEIA initiative, which provides valuable training to small teams to equip personnel with the skills and knowledge needed to implement sustainable strategies. This attests that companies can make meaningful progress by collaborating with suppliers, external partners, and other brands (24).

It takes total brand commitment to provide financial and technical resources to suppliers to build capacity and promote sustainable solutions. Fortunately, companies, both big and small, are taking the leap into this uncharted territory in an effort to mitigate the impact of their operations and take responsibility for their actions. Who will be the next corporate champion? (25).

References

- FY21 NIKE, Inc. Impact Report. NIKE, 2022. NIKE, https://about.nike.com/en/newsroom/reports/fy21-nike-inc-impact-report-2.

- Net-Zero Challenge: The Supply Chain Opportunity. World Economic Forum, Jan. 2021, https://www.weforum.org/reports/net-zero-challenge-the-supply-chain-opportunity/.

- The Higg Index. Sustainable Apparel Coalition, Oct. 2022. Sustainable Apparel Coalition, https://apparelcoalition.org/the-higg-index/.

- Higg Index, https://howtohigg.org.

- Scope 3 Inventory Guidance. United States Environmental Protection Agency, https://www.epa.gov/climateleadership/scope-3-inventory-guidance.