Melanie Rua

Senior Associate of ESG Research, Bloomberg Intelligence

Waste is rapidly emerging as a critical concern for businesses, regulators and investors alike. With the anticipated finalization of a Global Plastics Treaty by the end of 2024, waste management is becoming central to the ESG agenda, reshaping corporate strategies and innovation. As we move closer to this regulatory milestone, the interplay between policy, market forces and corporate strategy offers risks and opportunities, underscoring the need for a circular approach to resource management.

Global Regulatory Pressure

In 2022, 175 nations adopted the UNEA Resolution1 to End Plastic Pollution, signaling a global push to curtail waste. The forthcoming treaty could reduce plastic pollution 80 percent by 2040 using existing technologies, according to the United Nations Environment Programme (UNEP). Parallel efforts, such as the EU’s Packaging Regulation2, target a 15 percent % reduction in packaging waste per capita by 2040 and 100 percent % recyclability by 2030. The US has expressed interest in joining this resolution, though this commitment may shift under president-elect Donald Trump. However, state-level action is likely to persist, with multiple states introducing extended producer-responsibility (EPR) laws3 that hold companies accountable for end-of-life management of their products. These initiatives reflect the urgency of transitioning away from a linear “take-make-waste” model to a circular economy that prioritizes waste reduction, reuse, and recycling.

These regulatory frameworks coincide with heightened investor scrutiny. On Bloomberg Intelligence’s podcast, ESG Currents, we recently discussed how investor coalitions such as Nature Action 100 are pressuring companies to address nature-related risks involving waste like microplastic pollution and hazardous chemical runoff. Featured guest Adam Kanzer, the head of Stewardship Americas at BNP Paribas Asset Management, detailed how corporate engagement and proxy voting can drive meaningful progress on these issues.

Financial Implications: Investor and Market Dynamics

Investors are increasingly aware of waste as a material risk. However, the financial sector has been slow to respond. Our analysis4 shows only half of the top 20 banks by market cap have policies addressing the impact of loans on waste, though this is likely to change as shareholder pressure and regulatory frameworks evolve.

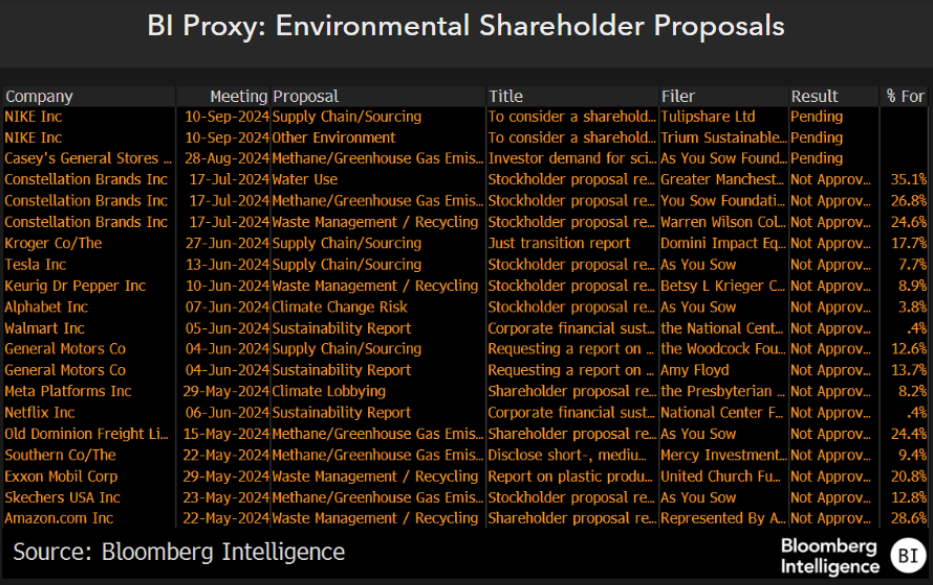

Investor coalitions are also driving the agenda. For instance, a group representing $10 trillion in assets under management5 has targeted consumer-goods companies to reduce plastic waste, highlighting the potential for reputational damage and lost revenue. Yet while waste-focused shareholder proposals rose 57 percent 6 in 2024 vs. 2022, average support fell to 15 percent from 52 percent in the same period. This decline suggests a disconnect between awareness and actionable commitments.

A Circular Economy for Nature and Opportunity

A circular economy offers solutions to reduce the strain on natural ecosystems and companies are responding with innovative strategies. Colgate-Palmolive7 is transitioning toothpaste tubes to recyclable alternatives, while Coca-Cola8 is increasing the use of recycled PET in its packaging. Similarly, industrial leaders like LyondellBasell9 are investing heavily in circular solutions. The company launched its Circular and Low Carbon Solutions business to produce at least two 2 million metric tons of recycled and renewable-based polymers annually by 2030 and issued an inaugural $500 million green bond in 2023 to fund circular-economy projects. It estimates 20 percent % of its total capital spending in the next two years will go toward climate and circularity ambitions, with $400 million planned for 2024. Neste is also advancing the circular economy with a €111 million investment in its Porvoo refinery, upgrading 150,000 tons of liquefied plastic waste annually to create feedstock for new plastics, with a goal of scaling capacity to 400,000 tons a year.

Companies like Tesla and Aquafil exemplify the financial benefits of circularity. Tesla10 reports that all of its batteries are recycled, resulting in resource and cost savings. At the current price of $16,500/metric ton for nickel, the company recovered the equivalent of about $40 million in 2023. Similarly, Aquafil11 has developed ECONYL, a regenerated nylon yarn for clothes and carpets made from pre- and post-consumer waste. ECONYL cuts emissions by up to 90 percent% compared to oil-derived nylon and is recyclable at end of life. Used by 1,700 brands, including Prada, H&M and Maserati, ECONYL accounted for 50 percent % of Aquafil’s fiber sales in 2023, up from 37 percent % in 2021, with a compound annual growth rate of 7.3 percent % vs. a decline of 3.3 percent for other fibers from 2018-23. These efforts, though incremental, demonstrate the potential of circular solutions to address environmental challenges while unlocking new economic opportunities.

Despite progress, significant challenges remain. Many companies are missing or postponing ambitious waste targets. Unilever12 has revised its goal of halving virgin plastic use by 2025, extending timelines to 2026 and 2028 for incremental progress. Similarly, 80 major US companies belonging to the US Plastics Pact13 delayed their 2025 goals to 2030. These setbacks highlight the complexity of implementing scalable, impactful waste solutions across global supply chains.

Moving Forward

Whether through proxy voting, innovative technologies or targeted investments, the shift toward a circular economy isn’t just an environmental imperative—it’s an economic opportunity waiting to be realized. The Global Circular Economy Market is valued at $553 billion in 2023 and is projected to grow about 13.19 percent % compounded annually from 2024-30, according to MarkNtel Advisors.14. This growth is driven by escalating concerns about environmental degradation and substantial waste generation across various product categories, fueled by a rapidly growing global population.

Innovation is central to this market transformation, with businesses pioneering advanced technologies, sustainable materials and novel business models to drive the shift toward circularity. By focusing on solutions rather than symptoms, we can turn waste management into the next frontier, setting the stage for a future where zero waste becomes as universal a goal as net zero. The journey to zero waste might be long, but as we’ve seen, the momentum is undeniable.