Debra Everitt McCormack

CEO, McCormack Advisory Group

Boards of directors play pivotal roles—acting as a fiduciary to protect the interests of the stakeholders and assets of the organization and overseeing the organization’s strategy, risk appetite and capital allocation for the long-term success of the company. Board members perform their stewardship role using powerful questions, robust discussions, respectful debate, and dialog with management, investors and other stakeholders.

Board responsibilities

Key board responsibilities include the hiring and firing of the CEO, CEO succession planning, overseeing executive leadership and talent, reviewing and approving corporate strategy, monitoring operational, financial, legal and regulatory compliance and ethical risks, understanding and questioning decision-making, and balancing stakeholder interests. Another critical responsibility is managing the board itself—maintaining the appropriate board composition aligned with the strategy of the organization, assessing the board and addressing both the board and company culture. On average, S&P 500 companies have nine independent board members who attend approximately eight board meetings each year. Fulfilling their responsibilities, which include attending meetings, preparing for them, and participating in other governance-related activities, requires each board member to commit approximately 250 hours annually.

How can a board get all of this done? First, the board and committee chairs, CEOs, and management liaisons to the board and its committees carefully manage the agendas and materials preparation for board and committee meetings, focusing on the requirements included in the company by-laws and committee charters, regulatory requirements, and high-priority business topics. Second, good board and committee chairs judiciously facilitate the topics on the agenda, diligently keeping the discussion moving forward while engaging all of the voices in the room. The not-so-good chairs—that is a topic for another article!

Board members should be aware of short- and long-term trends that could disrupt their industry or organization and anticipate risks and critical issues that may harm the company in the future. Gaining this awareness often involves preparatory work such as staying informed about the industry by reading trade publications, newspapers, and books. It can also come from engaging with experts invited to speak on current issues during board meetings or through participation in external board education programs. One such topic has been sustainability.

The focus on sustainability is evolving. For some organizations, its importance is diminishing as a result of current events—from recent shifts as companies retreat from sustainability goals to multiple court cases challenging legal precedent, to investors removing sustainability from their voting policies, and countries delaying or abandoning sustainability reporting requirements. Other organizations continue to prioritize sustainability as a strategic business opportunity.

Sustainability and the board

As with many topics on the board’s agenda, there is no single correct approach to where sustainability oversight should reside at the board level. Unlike audit matters governed by regulatory guidance that dictates the responsibilities of the Audit Committee —including the hiring of auditors and the need for a financial expert—sustainability oversight lacks a universal framework. Each board must determine the most appropriate approach based on the company’s specific circumstances. This decision may involve assigning sustainability responsibilities to an existing committee, such as the Nominating and Governance or Audit Committee, or establishing a dedicated sustainability committee. Boards must also make certain that committee charters and disclosures are updated to align with evolving board or committee assignments, additional regulatory requirements and stakeholder expectations.

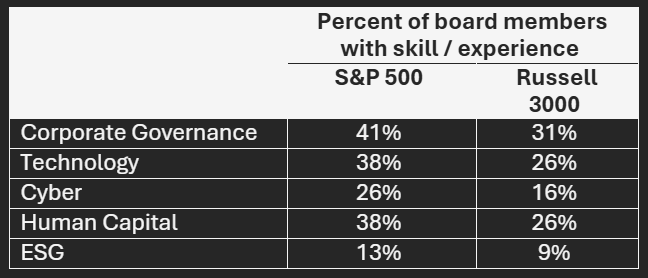

Sustainability has increasingly integrated into board governance due to inquiries from investors, regulatory requirements and employee activism. A recent survey highlighted board members’ skills and experience across sustainability-focused topics:

Dedicated ESG or sustainability committees, on the other hand, remain rare. Only 3 percent of S&P 500 companies and 4 percent of Russell 3000 companies have such committees. Recent surveys indicate that:

- The primary oversight responsibility for sustainability resides with the Nominating and Governance Committee (63 percent).

- The Audit Committee is responsible for oversight of ESG information (34 percent).

The board’s role in sustainability

As sustainability expectations continue to evolve, boards must continue to consider:

- Company strategy – understand how the company’s sustainability strategy aligns with the overall approved corporate strategy, the company’s sustainability goals and how the company will achieve them.

- Risk appetite – comprehend and appropriately monitor the company’s risk appetite associated with sustainability, materiality assessment and the concept of double materiality—the financial and non-financial impact—understanding the impact of operations on the environment and society, and the related influence on financial performance.

- Disclosure and reporting – stay current on changing requirements, monitoring regulatory updates and compliance standards. Be aware of governmental disclosure requirements and stakeholder expectations and share a comprehensive sustainability story.

- Monitor and measure progress – confirm that the company’s purpose is aligned with the company’s business and sustainability strategy. Review and discuss the annual results with the management team—were the results met? Is the company on target? What needs to change? What are the barriers to success?

- Education – keep current on upcoming requirements and competitive intelligence. Focus on the ecosystem-wide challenge. Help committees and the board understand upcoming reporting requirements.

As the role of the board and sustainability continues to evolve, it is essential board members stay current, considering the dynamic regulatory environment, shifting political landscapes, and future value creation for their organization. This approach will not only enhance long-term value but also mitigate risks in an increasingly complex global regulatory environment. By focusing on effective governance, strategic alignment, and stakeholder engagement, boards can navigate sustainability challenges and opportunities effectively.