Kogod School of Business

Dean David Marchick was invited by Ambassador Katherine Tai and Secretary of Commerce Gina Raimondo to join 13 IPEF partner countries at the first-ever in-person Indo-Pacific Economic Framework Ministerial.

In his remarks, Dean Marchick highlighted the importance of embracing stronger environmental and labor standards to make countries more attractive for investments.

Dean Marchick's remarks as prepared for delivery are below:

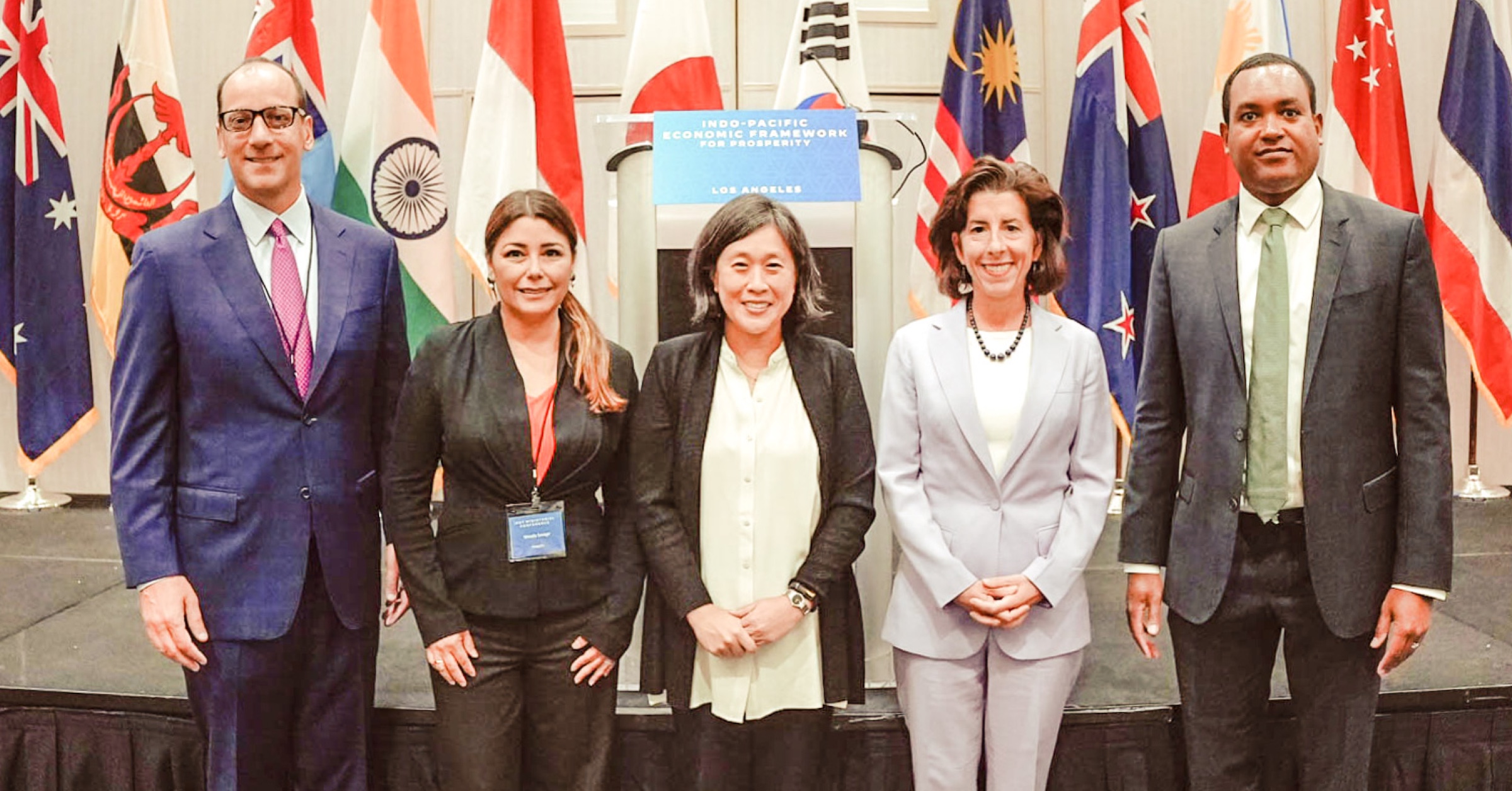

Dean David Marchick (far left), Wendy Savage, Director of Social Responsibility, Traceability, and Animal Welfare at Patagonia (center, left); Katherine Tai, United States Trade Representative Ambassador (center), Gina M. Raimondo, US Secretary of Commerce (center, right), and Grover Burthey, Executive Vice President of PIMCO (far right)

Thank you, Ambassador Tai and Secretary Raimondo, for your leadership and for inviting me here. I would be remiss if I did not thank Secretary Raimondo for her time and wisdom when she served on my board at the US International Development Finance Corporation.

I speak today with hopefully some relevant experience—I served as a trade official for seven years, then as an attorney advising investors and companies on international investment. For 12 years, I served as a senior executive of one of the largest investment firms in the world. I then served as the Chief Operating Officer of the United States development bank and now am the Dean of the business school at American University, which hosts one of the leading sustainability programs in the United States.

I am an enthusiastic supporter of the goals of the Indo-Pacific Economic Framework for Prosperity. This initiative will strengthen ties, increase trade and investment, and raise living standards in each of our countries. Today, Secretary Raimondo and Ambassador Tai asked me to speak on sustainable investment.

Sustainable investment by the largest asset owners in the world—pension funds, investment funds, insurance companies, and asset managers—is the fastest-growing investment area. Blackrock reports that sustainable ETFs represent the fastest-growing part of public equity and debt markets. In a survey, the London Stock exchange reported that 84 percent of asset owners implemented sustainable investment strategies in 2021, double the number from 2018. PWC predicts that investments in this space will triple over the next three years. Countries and companies are competing for this investment.

How does this relate to the IPEC?

Companies and investment firms consider a number of factors when making investment decisions— the quality of the workforce, the strength of the infrastructure, access to markets, and, increasingly, a variety of sustainability metrics.

Thus, by embracing stronger environmental and labor standards, countries and companies will be more attractive, not less attractive, for investments.

David Marchick

Dean, Kogod School of Business

Let me give you an example—we are increasingly seeing severe weather events around the world as a result of climate change. My former investment firm owned a manufacturing company with facilities worldwide. One of its facilities was hit by a severe weather event. It first caused flooding. When the flood receded, the power stayed off for a week. When the power came back, the workers could not show up because they were fixing their homes and taking care of their kids since schools were closed. It severely hurt productivity. This was not in a developing country. It was not in Asia. It was Houston, Texas.

When we invested in this company nine years prior, we did not even consider whether a severe weather event could harm the company. My former firm now requires that environmental, social, and governance issues be considered in every investment.

In fact, data supports this anecdote. Research by Jennifer Oetzel, a professor at American University’s business school, demonstrates that business leaders are increasingly making investment decisions with disaster preparedness in mind. Her research concludes that those environments or locations which are less likely to face severe weather events, and those locations which have more capacity to manage disasters, are more likely to receive more investments. Thus, if your country demonstrates that it has the capacity to mitigate the impact of severe weather events or other disasters, you will be more attractive as an investment environment.

The same logic applies to labor standards since companies want to invest in locations where labor rights are protected and where poor labor standards will not harm a company’s reputation.

Companies today are actively exploring moving facilities out of countries where environmental or labor standards create reputational risk. It takes decades to build a reputation, but that reputation can be destroyed in a moment. Companies are no longer willing to take that risk.

In 1993, I worked in the White House on NAFTA, the North American Free Trade Agreement. At that time, President Clinton pressed for stronger labor and environmental standards. Business was opposed. Investors were opposed. Mexico was opposed.

Thirty years later, the equation has changed. The market has changed. Investors have changed. And attitudes in board rooms have changed. Businesses see environmental, social, and governance issues as central to their business—and their reputation. Today, by strengthening your commitment to sustainability, you will attract more, not less capital, leading to more jobs, higher wages, and better standards of living for your people.

That is why I applaud this work stream in the IPEC, and I very much hope that you and your leaders can work toward a broad agreement between our countries.

Thank you for the opportunity to speak with you today.